Employers that sponsor self-funded health plans entrust Third-Party Administrators (TPAs) with millions—often hundreds of millions—of dollars in plan assets. When a TPA exercises discretion over claims adjudication, pricing, or plan management, federal law treats that administrator as a fiduciary under the Employee Retirement Income Security Act of 1974 (ERISA).

ERISA requires fiduciaries to act solely in the interest of the plan, with undivided loyalty and prudence, and to avoid conflicts of interest and prohibited transactions. That fiduciary status is not optional, and it carries severe legal consequences.

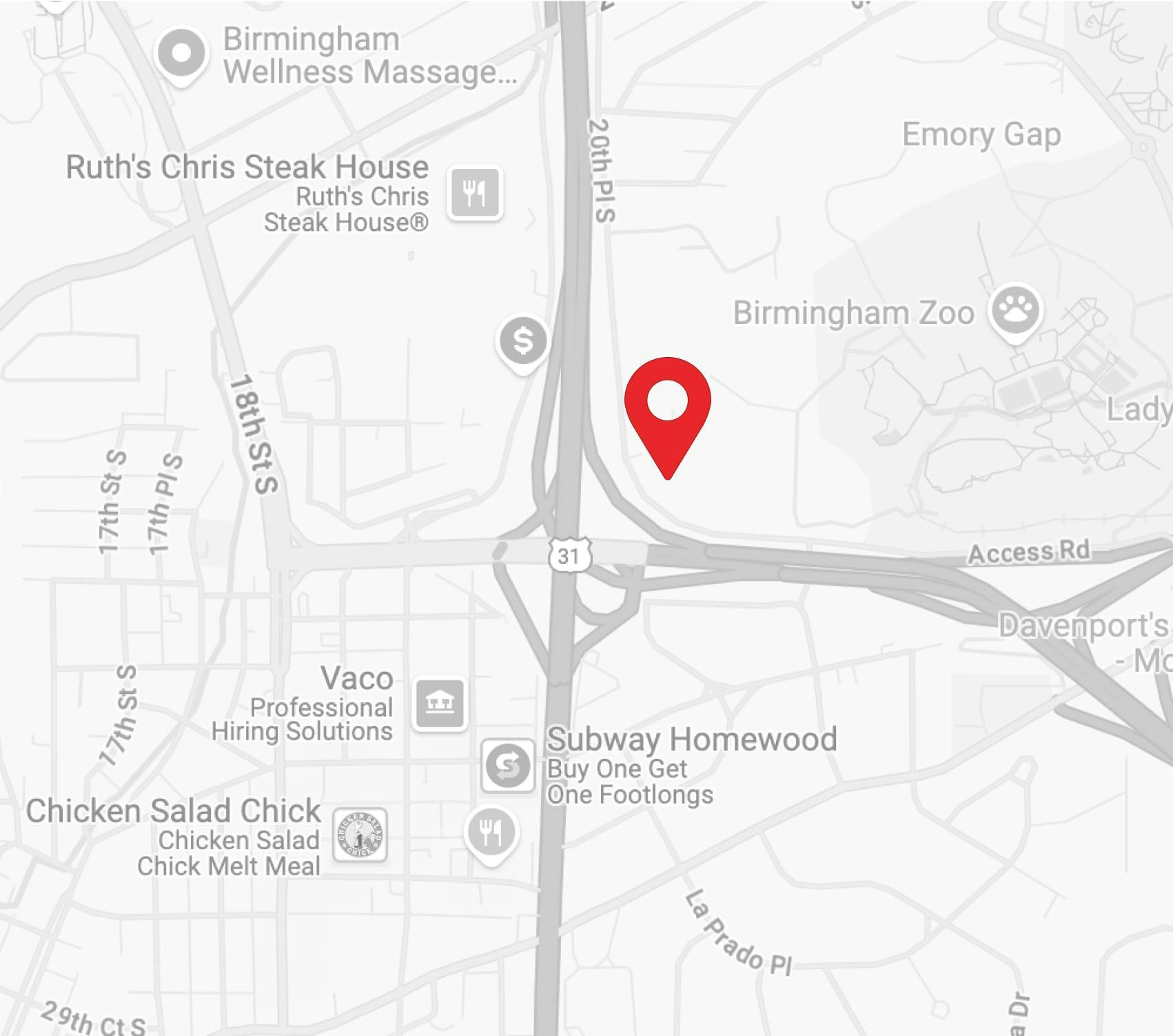

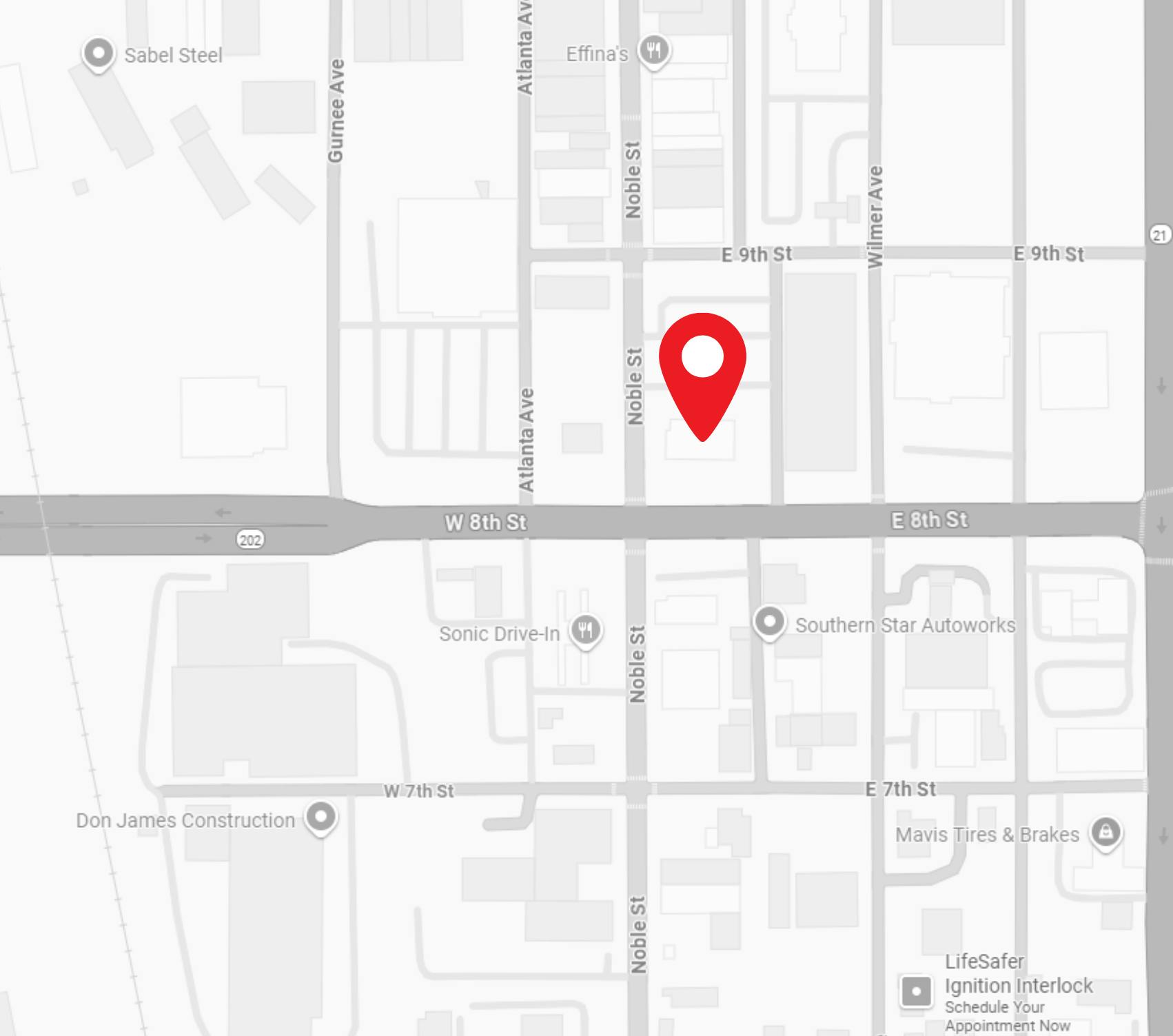

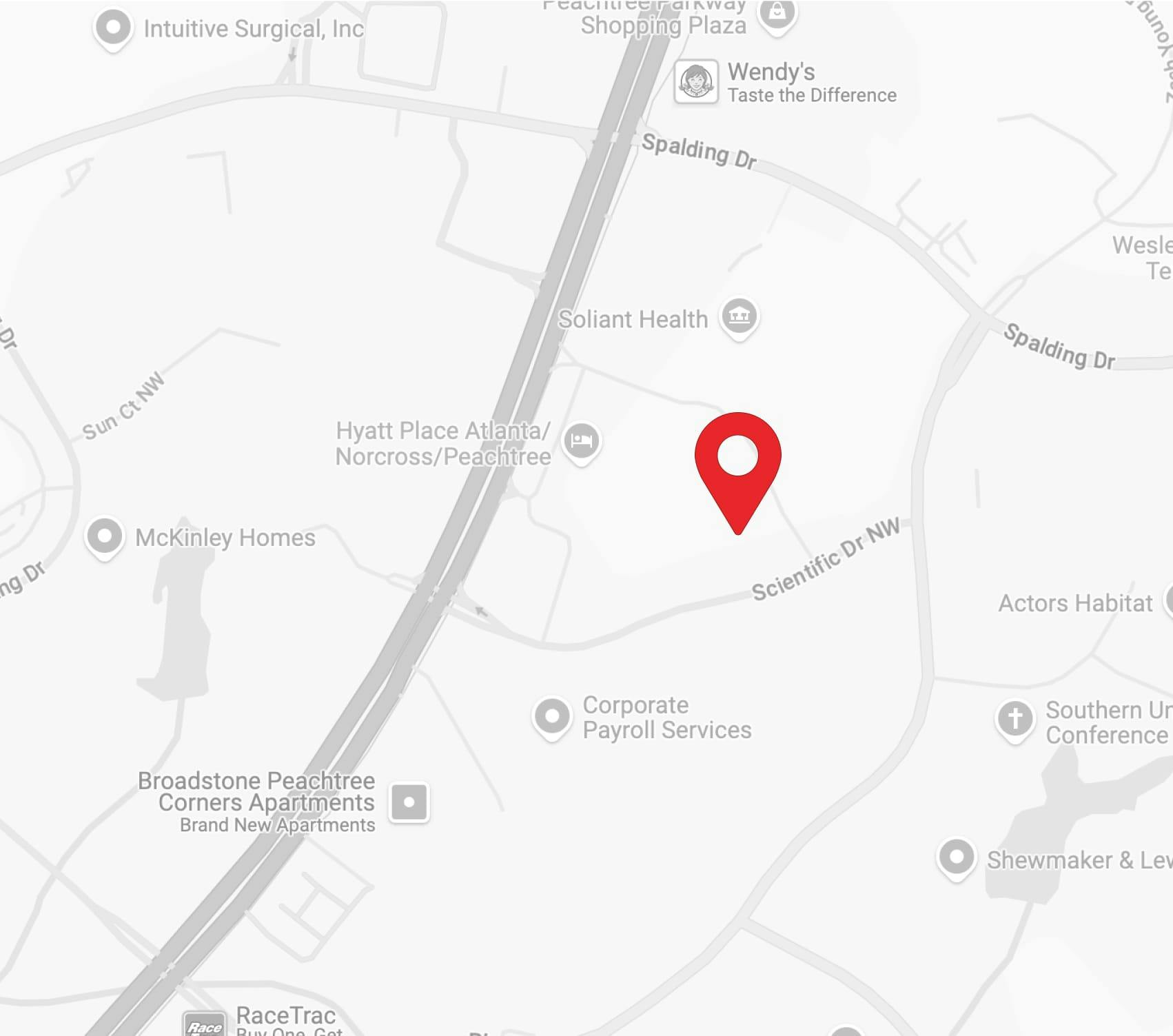

When TPAs prioritize profit over compliance, we step in. Turnbull, Moak & Pendergrass, PC investigates and litigates claims nationwide on behalf of plan sponsors when TPAs violate their ERISA duties by mismanaging claims, engaging in self-dealing, or concealing misconduct. Our firm is built for high-stakes litigation, and we bring the same trial-first discipline to fiduciary breach cases that we apply in catastrophic injury and complex commercial matters.